Colorado Real Estate Journal - Determining asset values without transactions

- News

- May 26, 2023

- No Comments

- mveremeychik

The correlation between interest rates and capitalization rates has always been obvious to our industry. As interest rates move, cap rates follow in the same direction. The degree to which they fluctuate- in concert with one another is nuanced and depends on risk assessments or supply and demand forces. Similarly, there is correlation between the federal funds rate and U.S. Treasury bond yields. The speed at which interest rate increases have impacted asset values has been sudden and dramatic in the last 12 months. During this time, the Federal Reserve has tightened monetary policy (10 increases of the federal funds rate totaling 5%) as the 10-year U.S. Treasury note has increased by 2.5%. Same direction, but differing amounts. While we understand the link between the cost of capital and asset values, a similar dynamic of correlation without mirroring is taking place. The commercial real estate market is working through the process to find clarity in how the new reality of borrowing yields have impacted corresponding valuations when looking to buy, sell or refinance. The change and uncertainties have led many clients to ask us what we think a property would be worth, if sold, but the lack of recent transaction activity requires valuations to be justified by reasons other than recent comparable sales.

The headwinds facing retail properties over the last decade were well documented and headline-worthy clickbait. In the post-COVID-19 era, the product type has been in wonderful health, but the positives seem to be less advertised than the prior fears. The herd mentality kept pricing at a relative discount, as compared to multifamily or industrial, as investors thought there was macro risk of e-commerce and diminishing tenant demand. Thus, the retail product type strength has improved during the time when the cost of capital is reducing asset values, placing a counterbalancing or stability effect on retail property value. Put another way, retail investors have been able to acquire properties at slightly lesser values than prior to the Fed’s tightening, but they are also accepting lesser yield at those lower prices, demonstrating that retail property values are not directly correlating with interest rates and both buyers and sellers are contributing to absorbing the new reality.

In many respects, it is still a seller’s market due to the competitive environment to acquire a given asset. With the general lean toward positivity and optimism, the reader may wonder, “Where are all the transactions to support these claims? Where are the opportunities to acquire?” We receive a version of this question daily. Investors want to buy retail, and there is seemingly never enough supply in the Denver market to satisfy the demand. This isn’t a new phenomenon; in 20 years, I cannot recall a time when there were too many retail properties to acquire in relation to buyer demand. There are many transactions currently underway at some point in the process. Private capital interests will dominate, but a few institutional acquisitions appear likely during second-quarter/third-quarter 2023. The investors who see the glass only half full, or who expect future distress, will need to continue with patience to have any chance of an accurate prediction. There is simply too much equity seeking quality retail investments in Denver to experience a dramatic discount.

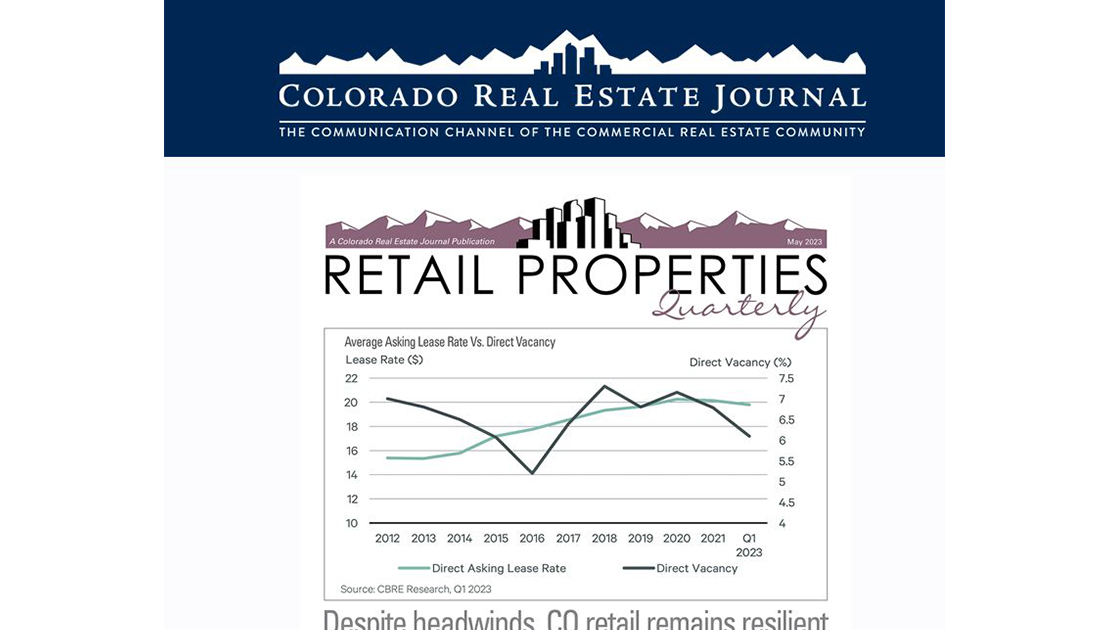

We would have nothing to sell if it weren’t for the tenants. Retail leasing brokers continue to indicate that demand for well-located space is extremely strong. The data supports the anecdotes. The Cushman & Wakefield research team suggests the metro Denver direct vacancy rate is now 5.1% as compared with 5.6% nationally. It should also be mentioned that Colorado Springs is even tighter at 5%. The Denver market has experienced positive net absorption of 879,000 square feet over the last 12 months. The same period has experienced inflationary pressure on tenant improvement costs, increased wages and salaries, and challenges in securing business loans. Denver’s consumer is strong, which is allowing the retailer to remain resilient in challenging macroeconomic times. he owners of retail properties often look to the brokerage community to offer perspective on what a given property is worth. Throughout this article we have suggested that the demand for retail acquisition is as strong as ever, on-market supply is limited, the leasing climate is providing for strong rental rate growth projections, and investors are accepting lesser yield than in the prior low interest rate environment. Current pricing trends will begin to be revealed in the second or third quarter of this year, and it will also demonstrate that when interest rates rise, property values decline, just not in synchrony. Assuming the cost of debt capital is beginning to plateau, it would be reasonable to assume that property values will have reached a relative low point and we can reestablish meaningful transaction velocity to support valuations beginning in the second half of 2023.